Work Abroad Before You Retire

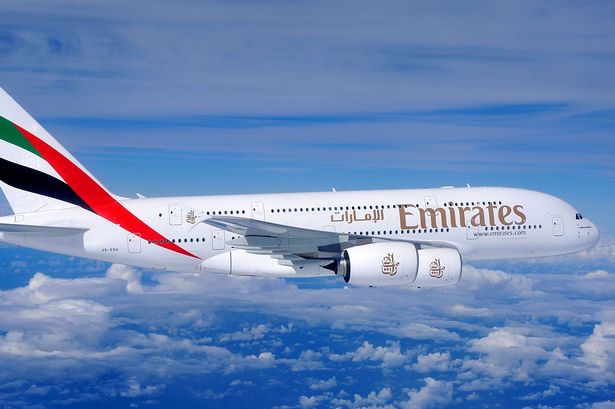

If you are well aware of the retirement crisis in the first world or worried about your own retirement, then you have come to the right place. In an earlier post, we saw how a simple decision to rent, while giving you the opportunity to be globally mobile, can help accelerate your journey towards financial independence. Once you learn to move and thrive in your new role for work in a new place, you will not worry about doing the same in retirement to enjoy a higher quality of life.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.