This article takes off from the groundwork we established in Part 1. In writing this series, I have started with the well-supported premise that over the long-term, equities are the best asset class to remain invested in. In addition to my article on the efficient frontier, there are several excellent books and good resources on the internet including the PF blogosphere that talk about long-term investment in equities, so I will avoid repeating the equities ‘case’ in this series. As I said in Part 1, even within equities, a discussion about dividend growth investing (DGI) versus equity index investing is a bit about splitting hairs but for good reasons.

Indexing has far fewer decisions involved than a DGI. As a US indexer, you can choose between VOO and SPY as index ETFs or between VTSAX and FSTMX as index mutual funds, but that’s only a choice between two fund companies. The underlying assets are the same. Both VOO and SPY mirror the S&P 500 index. While the fees to run an ETF varies across fund management companies, the investments are the same. Same wine in different bottles, or for you beer drinkers, same beer in different mugs. Both aim for capturing the total return offered by the basket of companies in the S&P 500 index.

In comparison, a DGIer thinks differently – specifically, he or she thinks income. DGI is fixated more on income largely because the portfolio’s success is measured by the ability to finance a retired investor throughout life. Dividends are far more stable than capital appreciation, as the Ibbotson study showed.

Therefore, the income that a portfolio generates, and its stability and growth are the primary factors of interest to a DGI investor. A DGI investor can assemble a portfolio of dividend-paying stocks that matches their unique needs for income and its growth. There is no one-size-fits-all dividend portfolio as it can be in an index portfolio for same risk profiles.

DGI Portfolio: Design Your Own For Yield & Growth

Building a DGI Portfolio starts with 4 essential ingredients that come from answering these questions:

- How much money do you have to invest (and/or will invest monthly)?

- How much income do you need and by when?

- How much growth of that income do you need?

- How much variability in that income can you handle? (in other words, risk measured as income variability and not portfolio value change)

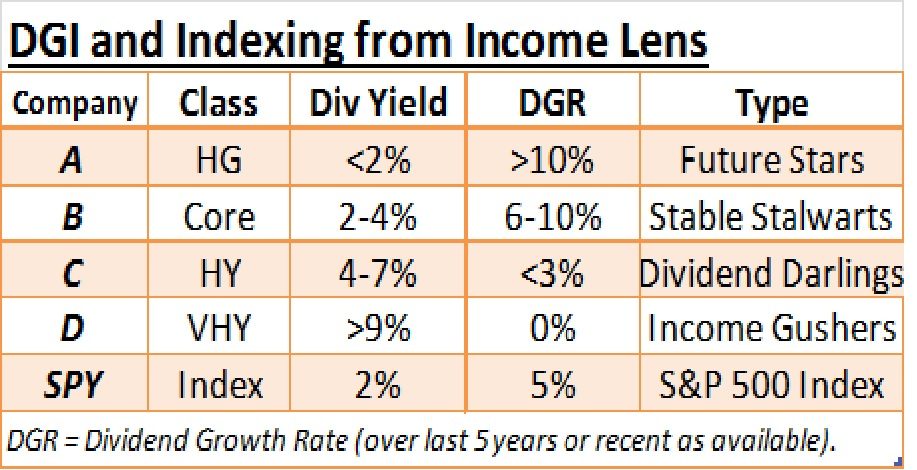

We saw in the previous post about various types of dividend-paying companies classified according to dividend yield and annual dividend growth rate. That table is reproduced below for reference.

There are over 3,000 companies that pay dividends among the universe of over 10,000 publicly-traded companies in many stock markets. This is the grand ‘pool’ from which a dividend investor starts his journey. From here, you can use various metrics like dividend yield, payout ratio, P/E ratio, Debt/Equity, Credit ratings, S&P IQ ratings, country preferences etc. to cull down the list to an invest-able shortlist of say, 100 stocks. From here, you can apply further valuation considerations and sector-based filters (say, you want to remain invested in all sectors or not have one sector contribute more than say, 25% of your portfolio size or income) to come up with a well-chosen and diversified portfolio of dividend paying stocks to match your income and income growth goals.

On the article about portfolio longevity, we brought in three hypothetical investors: Adam, Betty and Charlie, having identical 100% equity preference. Adam is 35, Betty is 45 and Charlie is 55. Thus, the only difference between them is their retirement span (or length). Let’s look at the same investors for the DGI portfolio as well.

Adam may not need much current income as he is young and has a long career runway ahead, but will need significant dividend growth while planning for his retirement. So, Adam, in choosing a portfolio of 30 stocks, may assemble his DGI portfolio to have a yield of 2% but has the potential for over 12% annual dividend growth. His DGI portfolio will have most of type A companies with some type B.

An investor in retirement or close to one like Charlie, choosing current income over growth, can put together a portfolio of another 30 stocks with a current yield of say, 6% and with growth of barely 2-3% (to match inflation). Charlie’s DGI portfolio will have many companies of type C and some of type D.

An investor like Betty can assemble a mix of stocks in her DGI portfolio to have a 3.5% dividend yield and 6% dividend growth. So, Betty’s portfolio will have many companies of type B, some of type A and type C and maybe one or two of type D.

A high degree of customization in assembling a dividend income portfolio to suit their needs is what attracts self-directed investors towards DGI.

How does the income profile look ?

For this analysis, I assumed that all three investors have a $500,000 DGI portfolio to start with and did not contribute any more in their investing journey (for the sake of simplicity). You can model the annual investments as well in the DGI analysis but in doing so, we will also have to consider that Adam starts most likely with less assets than Betty, who likely has less than Charlie on day 1. This is considering their age differences. For the sake of simplicity, and to illustrate a larger point, I have chosen the first example above. So, here we go:

Adam: 2% yield, 12% dividend growth, First year dividend income: $10,000 (2% of $500K)

Betty: 3.5% yield, 6% dividend growth, First year dividend income: $17,500 (3.5% of $500K)

Charlie: 6% yield, 2% dividend growth, First year dividend income: $30,000 (6% of $500K)

Importantly, they all spend the dividends they receive (no re-investment). Let’s say Adam and Betty supplement their earned income with nice vacations and other goodies from the dividends their portfolio generates, and Charlie is living on his dividends entirely. We will consider dividend re-investment in a different context later.

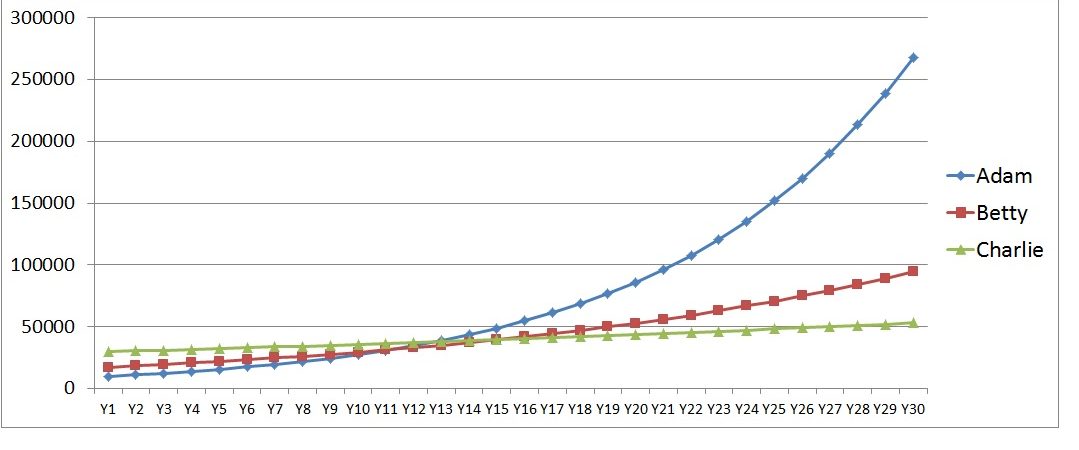

Annual Dividends Over 30 Year Investment Horizon

While Charlie clearly starts out with more income, the faster growth of Adam’s dividend income crosses Charlie’s income by Year 12. By Year 15, even Betty’s dividend income crosses Charlie’s. Adam enters the six-figure income league in Year 21, while Betty does so in Year 30. Charlie may die before his income ever reaches 6 figures, but don’t feel bad for him. He has enjoyed good income throughout his retired life.

The explosive dividend growth or the ‘magic’ of compounding becomes evident over longer investment horizons. Some of you may wonder if this growth is realistic. No company can be expected to grow earnings at 12% or more for 30 years. Actually, some have clearly done so in the past like Altria (MO), Wal*Mart (WMT), Amgen (AMGN) and Microsoft (MSFT) to name just a few. Considering today’s valuations are relatively high, and say, Adam is unlikely to identify such future growth stars in his portfolio, you may be right to see these high dividend growth rates as rose-colored projections. If you believe high dividend growth (supported by earnings growth) is just not feasible for a 30 year horizon but only possible for shorter horizons, you may be right! So, let’s consider a more ‘realistic’ picture below.

How does the income profile look….in possible reality?

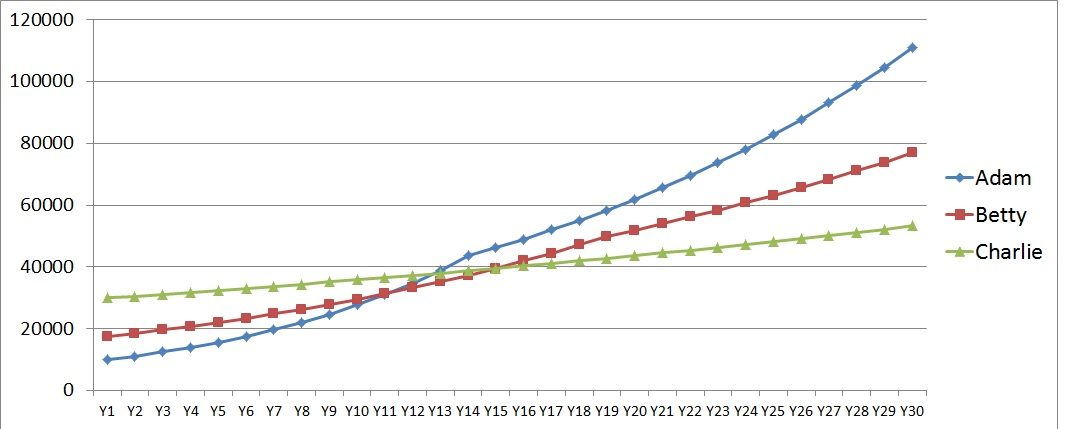

By tempering the growth rates of Adam’s and Betty’s portfolio, we can arrive at a more realistic picture. Because of low growth already assumed in Charlie’s case, there is no need for any adjustment in his 2% dividend growth assumption. For Adam, I considered that the future growth rate is cut in half (from 12% to 6%) from Year 15 onwards. For Betty, I assumed that 6% growth (which is reasonable) is tempered down to 4% (from Year 20 onwards) in her portfolio. This moderation also serves as proxy for occasional cuts in dividends that may come during recessions, often followed by rapid growth. Note that Social Security (not considered in this analysis) also kicks in from ages 62 or 67 or 70 (depending on the investor’s choice), which will bring in more income. It is, therefore, not accurate to focus on income figures year-by-year, but the relative trends are important.

Moderated Growth of Dividends over 30 Years

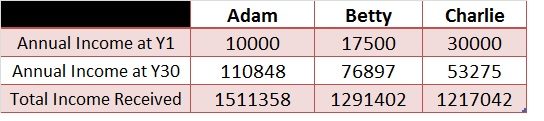

Dividend income growth is still very impressive for Adam and Betty while it remains subdued for Charlie because of 2% annual increases. While Adam’s and Betty’s dividend income still cross Charlie’s in Year 12 and 15, respectively, their future growth is tempered due to the moderating assumption we made. Still, Adam ends up with $100,000 in dividend income by Year 28 and Betty touches nearly $77K in annual income by Year 30. Charlie chugs along and reaches $53,275 in annual income by Year 30 but he is also 85 years old then and can hardly spend it all beyond his essential medical and living needs.

Adding the total income received over 30 years, it is not surprising that Adam and Betty receive the most. But what should surprise you is that Charlie, despite his low dividend growth, didn’t do too badly. He received nearly $1.22 million in dividend income over 30 years, very close to Betty’s $1.29 million. This is because of the first 12 to 15 years where he enjoyed higher income than Adam and Betty. The DGI portfolio gave Charlie the income he needed to have a comfortable retirement during relatively younger years (ages 55-70) of his retirement where the additional income would’ve certainly helped him in his travels or other pursuits. Beyond 70, he may not care about high income growth of his portfolio. Consider even Adam and Betty can switch over to Charlie’s portfolio when they reach their 60’s so that they too can receive an instant ‘step up’ in current income for the future growth rate they are willing to sacrifice. Income customization over an investing lifetime is the hallmark of a well-constructed DGI portfolio.

Happiness comes in different numbers

Charlie, at 85, feeling good about his DGI journey.

While incomes totaled over 30 years may not look very different for Adam, Betty and Charlie, their portfolio values will be entirely different. One of the advantages of a well-diversified DGI portfolio is that you are only living on the dividend income generated, with no sale of the portfolio’s assets. So, for those who wish to leave sizable legacies to the next generation or to charities, the DGI mindset offers a clear path to both current income and future bequests. If you don’t care about leaving much, you can customize the portfolio to earn more income (thereby compromising future value growth of portfolio). For those who have little need for high current income can emphasize more growth and leave a large asset base at the end for their legacy. Terminal value of a DGI portfolio is therefore correlated with starting dividend yield you structure the portfolio to deliver. This is where DGI mirrors the SWR studies done with broad indexes – larger the initial withdrawal rate, lower the terminal value.

Adam’s descendants must be delighted, while Charlie doesn’t care!

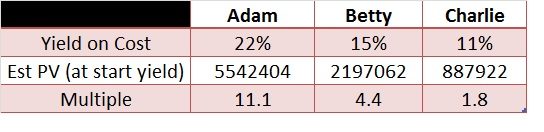

Assuming all the companies in the portfolio have similar P/E ratios at the end of the 30 year horizon as they started out with (in other words, the companies remain equally valued in the market at the end of 30 years), then the impact of the dividend growth on the final value of the portfolio is staggering. This is captured in the table above.

Remember, Adam started with a 2% yield, which is $10,000 annual dividend income on a $500K portfolio. At the same 2% yield (which implies similar market valuation) at the end of 30 years, guess what Adam now has: $5.5 million, or 11 times what he started out with! This massive portfolio is generating $110K in annual income. This is the power of compounding in action, and also the benefits of delayed gratification. For Charlie, the picture is entirely different. His portfolio is now worth about $900K, or less than double what he started out with 30 long years ago. His portfolio, at the same 6% yield, is generating $53K in dividend income, but remember he is now an 85-year-old who probably doesn’t remember where he keeps his glasses, leave alone the dividend paying calendar of his holdings. Betty, having taken a middle road, has a very comfortable retirement income and is also able to ponder a major legacy (>$2 million) that she can leave according to her wishes.

An important point here is that Charlie would’ve spent most of his retirement in relative poverty had he copied Adam’s portfolio. Had Charlie copied Adam’s DGI portfolio, he would wonder what the hell was he thinking to have so much money at 85 when he can’t even chew his food properly. So, Charlie’s original DGI portfolio of focusing more on current income was right for him, just as Adam’s and Betty’s focus on growth were right for them. All three investors were able to generate growing income that matched or exceeded inflation.

The bottom line is all three DGI investors are happy as their portfolio delivered for them what they wanted.

Remember the examples start with $500K portfolio, but the results are fully scalable. You can halve the income and portfolio numbers for all three investors if the starting portfolio size is $250K or you can double them for a $1 million starting portfolio. This way, you can easily apply the above examples to your own situation.

In the next articles, we will look at why income continues to be important even if you don’t believe in owning a single bond and maintain a 100% equity portfolio. We will also present a case where Charlie and Adam get close, rather too close in income profiles! We will also examine an index portfolio in more detail and see how an indexer views his income needs throughout retirement. Stay tuned.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

6 comments on “Dividend Investing vs. Indexing – Part 2”