I love Rockstar Finance (RF). It is my ‘go to’ resource to see what’s happening in the personal finance blogging world. I have had the privilege of having a number of my articles featured in RF and enjoyed the warm blanket feeling of seeing thousands of visitors on my site on the day I am rockstar’ed!

RF has several useful initiatives to support the blogging community and the eager ‘consumers’ of financial knowledge. I am sure ESI Money, who recently bought the RF website, will continue on the impressive progress made by J$ of Budgets Are Sexy.

Among their initiatives, perhaps the most eye-catching one is Rockstar Finance net worth tracker. This directory lists over 501 bloggers who share their net worth openly. I am currently rated #8 on that list. I was rated #7 up until last month when an update by Mr. Tako put him ahead of me.

I don’t track net worth frequently or even so accurately (as I deliberately under-value some assets to be conservative). If I did, I would have moved up further in this ranking.

That’s precisely the subject of this article. The point is….it’s largely pointless!

With 501 trackers reporting a total of $262.5 million in net worth, it is hard not to get impressed. We are talking an average of over $500,000 here, amidst a median age range in the 30’s among all bloggers.

This kind of net worth is such an outlier compared to the world and even the affluent North American societies that it’s not even funny. We often forget how rare this is.

Having a net worth of $500,000 for a mid-30’s household would put you among the top slice of North America, and in even more exclusive company in the rest of the world. I won’t bore you with details for these, because there are plenty of sources that you can Google yourself.

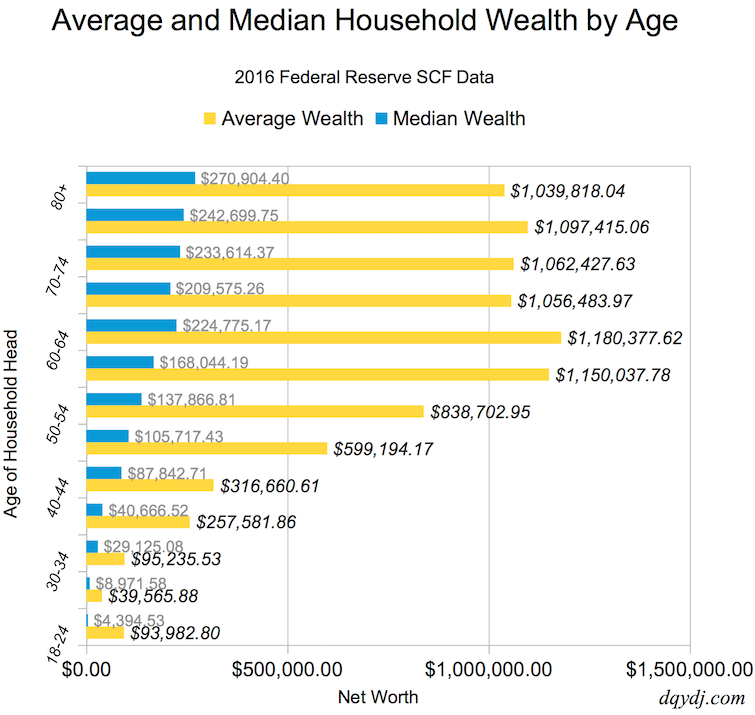

Instead, allow me to attach a chart (source) using the data from Federal Reserve (the grand-daddy of financial data collectors in the U.S.).

Did you notice the huge difference between ‘median’ and ‘average’ net worth in every age group? Median is the true middle-point, and the average is skewed by the very rich people at the top end of each age group. The table below shows how big this skewing effect is.

The median early 30’s household has a net worth of only $29,125, whereas the average in that age group is at $95,235, that is 230% higher!

Similarly, the 35-39 age group household has a median net worth of $40,666 but the average for that same age group is $257,581 or a massive 533% higher!

The top 1% or the top 10% of every age group often creates a wide gap between median and average.

For more proof, read the latest report from Oxfam. Their report is a key topic of discussion at the World Economic Forum where elite business and political leaders meet in Davos, Switzerland.

Oxfam got tired of repeating the warnings about wealth disparity in the world. They quit the subtle tactics this time and went straight with the title “Reward Work, Not Wealth“. Some of the stories in their report are heart-rending. What else can a reputed NGO do, when they face statistics like just 1% of the people captured 82% of all the wealth created in the past year!

The rich get richer, and skew the average further away from the median.

The point of all this is….there is a massive selection bias in the Rockstar Finance net worth directory. This bias can make rare things appear average.

Don’t let the word ‘bias’ throw you – I am using it in the context of psychology where it is merely a condition, often unintended. To understand this better, consider:

a) How many people in the 30’s-50’s age group would start a blog on any topic?

Perhaps 1 in 100,000.

b) How many of those blogs would be on personal finance with the objective to reach financial independence/early retirement (FIRE)?

Perhaps 1 in 50. This is actually generous, I gave the benefit of doubt towards personal finance because of my own confirmation bias.

c) How many of those PF blogs are focused on improving their net worth, and believe in sharing the numbers for the world to see? These are the bloggers whose net worth RF tracks.

Perhaps 1 in 25.

d) How many of those in c) have a net worth of $500,000 or above?

For this, the directory itself is a source of data. The $500K net worth line is currently at #167 – Dr. John Loftus @ The Fulsome Fiddler (awesome blog title, btw).

| 167 | Dr. John Loftus | The Fulsome Fiddler | 50s | Making Money | $500,000.00 |

That’s 167 out of 501 data points, so the odds to make it to the average net worth even within the directory are about 1 out of 3.

The median in this list is, by definition, at the middle, so at #250 of the 501 people listed. That is Chris Ball, with a net worth of $250,000.

| #250 | Chris Ball | Build Financial Muscle | 40s | General Finance | $250,000.00 |

If you calculate the ratio of average net worth to median net worth in RF tracker, it is only 2 ($500,000/$250,000). In other words, the average is just 100% higher than the median. This is vastly lower than the numbers we saw in Federal Reserve data above, showing the average net worth being as much as 533% higher than the median in the 30’s age group!

This shows that there is a ‘closeness’ among the financial achievements of self-selected members in a directory like this. This is another proof of the selection bias.

Do you still wonder if the RF Net Worth directory is representative of the top 1% of North American society for those average age cohorts?

Let’s see the math. We multiply the odds from the selections in a) to d). It’s that simple.

1/100,000 x 1/50 x 1/25 x 1/3 = That works to one out of 375,000,000 (or 0.00000027%).

So, Dr. John Loftus is among the rare 0.00000027% in the world and yet, he only has an “average” net worth as per the RF Net Worth Tracker. Yeah, way to feel bummed, right?

Where am I going with this?

Every person is a unique dish. Together we make a great meal!

If you read my FIRE Without Smoke article, you will sense the struggle bloggers like us face to keep our messages ‘informative’ and not ‘prescriptive’. People like us who choose to list our net worth on the RF directory unknowingly bias the list because, despite the anonymity many high net worth bloggers try to maintain, we still want the world to know the progress we have made.

Self-selection bias happens when people who have something to show are eager to show it, inadvertently creating a skewed image of what is possible for majority. They don’t represent the average of their age or country, which you know already, but they don’t even represent the average of similar net worth cohorts in many ways.

There are many common character traits bloggers who feature in the directory have. I think the valuable lesson for readers is not their net worth – but the common characteristics that all have, which led them to the self-selection bias in the first place!

Aspiring to have a $500,000 net worth is an amazing goal to have for many people, but thinking that this is typical in the PF world (just because it is the “average” in the directory) can also be demotivating. Moreover, it’s far from the truth as we saw above.

So, to the readers starting out on their FI/RE journey, please ignore our net worth stats. They should mean nothing to you. Importantly, see if any of the sacrifices (like I outlined in my net worth post) that it took us to get there is something you can relate to.

Also, focus on efficient investing and don’t stress about bench-marking your progress with others appearing on a list. Any list is bound to have selection bias. Because nobody else has your life.

If you still can’t get there, don’t worry. Nothing is lost. One person’s FIRE journey will be very different from another’s – it is your life goals that matter. And remember to make your journey worth your while along the way.

Be selective in your choices in life but consider the risk of selection bias. Happy journey, my 10! friends!

Does this apply to you? Share your views below.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

Pingback: My Financial Independence Journey: Monthly Update #14 (February 2018) | MoneyMow