Update: Another Destination Emerges

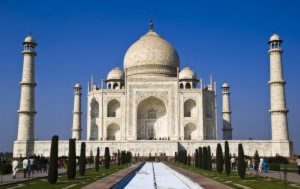

A wonder of the world beckons.

In my earlier article on working abroad, I mentioned the example of my American friend living and working in India. In the same article, I mentioned that India does not offer permanent residency or retirement visas for foreign citizens, unless they can prove Indian ancestry. My friend sent me an article last night that I want to share with you.

Guess what? Looks like the Indian government deliberated on my post and came up with this announcement. 🙂

India woos foreign investors with permanent residency status

But there is a problem.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.