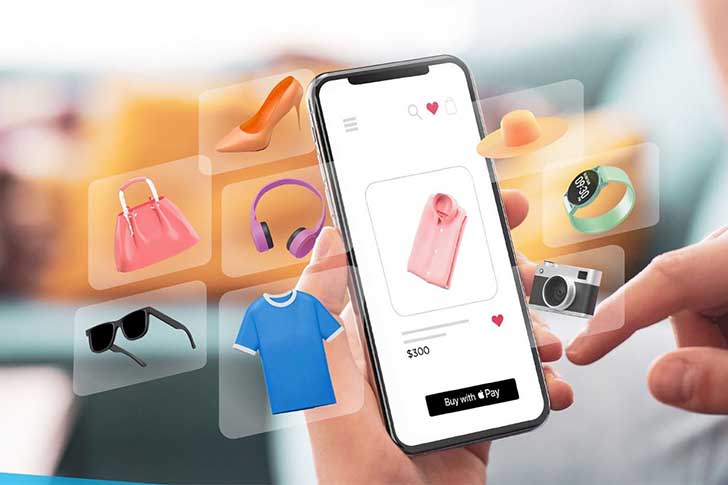

With the rise of contactless payments and improved infrastructure, using mobile payment apps has never been easier or more secure. After weeks of hands-on testing, two apps stood out as the top choices for 2024.

How We Tested

There are over 20 mobile payment apps on the market, so we narrowed our focus to five based on features, security, and user reviews. We tested Apple Pay, Google Pay, Samsung Pay, Cash App, and Venmo across multiple devices, including smartphones and smartwatches. Our evaluation criteria included ease of installation, setup, security, customer support, and fees.

We linked each app to various bank accounts and cards, testing them in retail and peer-to-peer (P2P) transactions. Finally, user complaints and customer support effectiveness were reviewed.

Apple Pay

networkonsocial / Instagram

Apple Pay is a top choice for iOS users, offering a sleek and intuitive interface across its devices. It's available in many countries but only allows peer-to-peer payments in the U.S. You'd need Face ID, Touch ID, or a passcode to set it up on your device. Transactions also come with a 2% cashback perk.

Google Pay

Moneycontrol / Instagram

Google Pay is a versatile option, available across Android, iOS, and web browsers. It's user-friendly and cost-effective, with no fees and support for immediate transfers via debit cards. You don't need a phone to complete online transactions, thanks to its integration with browser cookies. However, you'll need a personal Google account.

Cash App

Cash App, owned by Block—formerly Square—lets users create a unique username for easy money transfers—no need for a phone number or email. It's ideal for debit card users, though it has transfer limits for unidentified users. You can also set up direct deposits, make bank transfers, and even file taxes. A 3% fee applies for credit card transfers, and you can buy or sell Bitcoin directly within the app.

Samsung Pay

Samsung India / Instagram

Samsung Pay offers a convenient payment option for Samsung device users, but it's limited to Samsung smartphones and smartwatches. While it's similar to Google Pay, it doesn't support peer-to-peer payments and has compatibility issues with some debit cards. On the plus side, it works with NFC-enabled and older magnetic card terminals. However, setting it up can be a hassle, especially on Samsung watches.

Venmo

Tech Daily / Unsplash

Venmo is available only in the U.S. It is easy to set up and links seamlessly with a bank card. Like Cash App, it lets users send money with just a username. However, transactions are public by default, so switch to Private. Venmo supports various cryptocurrencies, and while bank transfers are free, credit card payments incur a 3% fee.

How to Safely Use Mobile Payment Apps

Mobile payment apps are convenient, but scammers are always lurking. A LendingTree survey found that 15% of users have fallen victim to scams, and many mistakenly believe their P2P balances are FDIC-insured. To stay safe, use strong authentication, enable multi-factor authentication, and set up transaction notifications. Be cautious—double-check all details before sending money, especially to strangers. Use your browser's stored card feature for online purchases for added security.

Our Top Two

Apple Pay and Google Pay top our list of the best mobile payment apps in 2024 because they offer unbeatable convenience, security, and widespread compatibility. However, when the conversation about whether smartwatches are more convenient for online payments than smartphones arises, we recommend sticking with a phone.