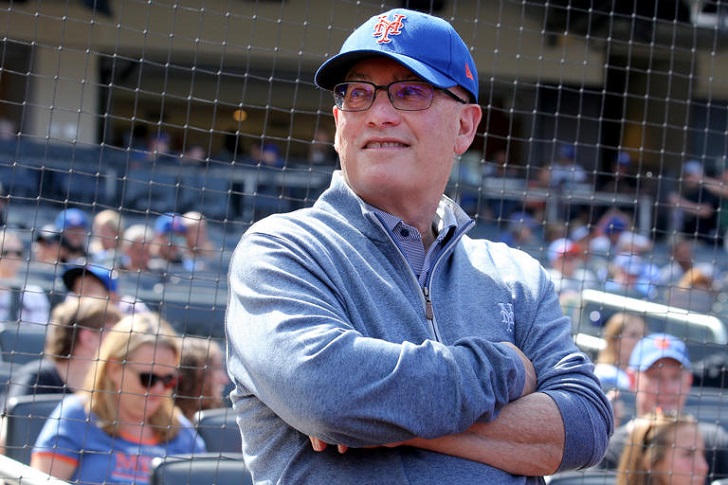

Steve Cohen is known for his strategic brilliance in both baseball and finance. Using his passion for baseball, Cohen applies tactical thinking from the sport to manage his hedge fund, Point72. His approach to leadership, decision-making, and performance management reflects lessons learned on the baseball field, where adaptability and results determine success. Here's how Cohen’s baseball mindset helped him build a billion-dollar empire.

Steve Cohen’s Trading Tactics Mirror Baseball Strategy

In baseball, managers constantly adjust their lineups based on players’ performance. Similarly, Cohen follows this principle at Point72. When his traders underperform, he quickly replaces them, just as a baseball manager trades players who fail to deliver. One of Cohen's former colleagues noted that he runs his business like a baseball team, where personal relationships take a backseat to results.

This no-nonsense approach has made Point72 one of the most successful hedge funds in the world. Cohen surrounds himself with top performers, ensuring the team is always at its best. By holding his employees to the highest standards, Cohen ensures that Point72 can adapt to changing market conditions, much like a winning baseball team adjusts to different opponents.

The Wall Street Journal | MSN | Cohen applies tactical thinking from baseball to manage his hedge fund, Point72.

Building a Winning Team

Like a seasoned baseball coach, Steve Cohen understands that success comes from assembling the right talent. He seeks out traders who consistently outperform and exhibit high discipline. Cohen sets up an environment where his employees are motivated to deliver their best work. Just like how a coach pushes athletes to prepare for game day, Cohen challenges his team to anticipate market movements and outperform competitors.

In Sunday meetings, he quizzes his team about upcoming market trends, preparing them to hit the ground running when the markets open on Monday. This intense focus on preparation has helped Point72 consistently generate strong returns, even in volatile market conditions.

High Standards and Quick Reactions

Cohen’s management style is based on real-time decision-making, much like a baseball manager adjusting tactics in the middle of a game. If a trader fails to meet expectations, Cohen is not afraid to make changes quickly. In his world, performance is everything, and just as a baseball coach would trade an underperforming player, Cohen replaces traders who don’t hit their targets.

This swift decision-making creates a culture of accountability at Point72, where employees know that only their best work will keep them on the team. Traders are encouraged to push themselves and maintain sharp instincts, constantly evaluating the market for opportunities.

Strategic Adaptation for Long-Term Success

Steve Cohen understands that his firm must adapt its strategies over time to stay ahead. Just as a baseball team studies its opponents and adjusts its game plan, Cohen adapts Point72’s trading strategies to suit changing market conditions. This flexibility has allowed the firm to thrive through economic ups and downs.

In fact, one of the reasons Cohen stepped back from day-to-day trading was to focus more on overseeing Point72’s long-term strategy. By stepping into more of a leadership role, Cohen ensures that the firm can continue to grow, even as he prepares for his eventual succession. His ability to shift gears demonstrates the same adaptability seen in great baseball coaches who evolve their game plans to maintain a winning record.

Larry Brown Sports | MSN | Steve Cohen adapts Point72’s trading strategies to suit changing market conditions.

A Focus on Performance Metrics

In baseball, teams rely on performance statistics to make decisions. Cohen applies a similar focus at Point72, constantly analyzing data to inform his trading decisions. He expects his team to operate with the same level of analytical precision, using every available resource to outperform the market.

Cohen’s deep understanding of market patterns gives him a competitive edge, much like a baseball manager who has studied the game for decades. His intuition and data-driven strategies have enabled Point72 to post consistent returns, even when other firms struggle.

Steve Cohen's Longevity Through Reinvention

Cohen’s success at Point72 can also be attributed to his ability to reinvent himself over time. Like a baseball player who stays relevant by adjusting his technique, Cohen has continually evolved his approach to trading. He transformed Point72 into a multi-manager hedge fund, allowing for a more diversified approach that reduces risk and maximizes returns.

This model, pioneered alongside other hedge fund giants, has become the gold standard in the industry. By ensuring Point72 remains flexible and adaptable, Cohen has built a business that can weather market storms and continue to grow.