Social Security has been the financial backbone for millions of retirees. However, experts are now sounding alarms. A growing number of finance pros say the system is under pressure, and your future benefits could take a serious hit if nothing changes.

The numbers come from official reports and real surveys showing Americans are worried. If Congress doesn’t act, Social Security could run short on cash by 2034. That is not decades away. It is right around the corner.

Dave Ramsey, a well-known finance expert, says the system isn’t built to be your only income in retirement. It was designed as a supplement, not a full paycheck. His warning is simple: Don’t rely on Social Security alone, because it might not be there in full.

Ramsey points to the 2034 deadline. That is when Social Security’s trust fund is projected to run dry. After that, benefits may be slashed by around 20 percent. His advice? Get serious about your own savings. Build up 401(k)s, IRAs, or other assets, and think carefully about when to claim your benefits.

Shevts / Pexels / The Transamerica Center did a recent survey and found that 71% of people who haven’t retired yet are worried Social Security won’t be there when they need it.

Even worse, 37% say benefit cuts are their top retirement fear. People aren’t just nervous. They are bracing for impact.

The survey reveals that the primary source of fear isn’t just financial concerns. It is politics. The longer lawmakers wait to fix the issue, the more unstable things get. The takeaway? You can’t afford to wait for Congress to get its act together. You have to prepare for less.

The Social Security Trustees, who oversee the program, put it bluntly. They expect the combined trust funds to run out by 2034. If that happens, payroll taxes will only cover about 79% of benefits. That means automatic cuts for everyone.

How to Plan Ahead

Retirement planning can’t be a guessing game. Experts say the smart move is to build a plan that assumes you will get less from Social Security than you expect. Financial advisor Doug Carey recommends planning for a 20 to 25% cut in future benefits.

If the cuts don’t happen, great, you will have extra money. But if they do, you won’t be caught off guard. Planning for the worst gives you more control and less stress in the long run.

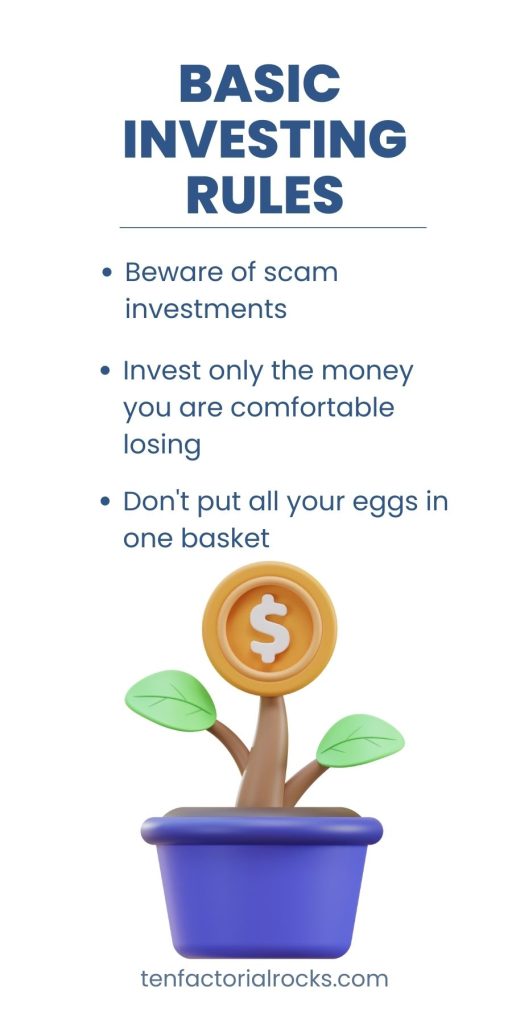

Olly / Pexels / Don’t assume Social Security will bail you out. Max out your 401(k), contribute to a Roth or traditional IRA, and invest wisely.

These accounts grow over time and aren’t affected by government shortfalls.

Personal savings also let you be flexible. You won’t have to delay retirement or pinch pennies if Social Security takes a hit. You will have something solid to lean on, no matter what happens in Washington.

How to Keep Up With the Changes?

This isn’t a set-it-and-forget-it situation. Social Security’s future is tied to politics, policy, and economics. It will continue to change, and you need to stay informed.

Start by reading the Social Security Trustees’ annual report. It is dry, yes, but it is the most reliable source of info out there. It tells you exactly where things stand and how close we are to those benefit cuts.

Also, keep an eye on proposals being discussed in Congress. Some lawmakers want to raise the retirement age. Others want to increase payroll taxes. Some are pushing to change how benefits are calculated altogether.