People often say that money basically makes the world go round, especially nowadays where people revolve themselves around material things that can, of course, be bought with money. Because of this, money seems to be manipulating people even if it is technically not doing anything, experts believe that money definitely changes people and unfortunately, once they let money get to them and eventually change their behavior, it would then affect their relationship with other people.

DOES MONEY CHANGE PEOPLE?

There have been several studies conducted when it comes to how exactly does money have to do with people changing. A research done by Psychological Science says that wealth may put barriers between a couple when it comes to feelings of empathy. Basically, people who are living the lavish life may find it difficult to deal with people who do not live like them or less wealthy people. Michael Kraus, one of the authors of the study said that in most cases, people from lower economic classes tend to be more empathetic towards their partners, unlike wealthy people. He explained that people with a lower social and financial status experience rather different occasions, with their lack of wealth leading to the increase of their awareness when it comes to threats, ambitious plans and theirs peers' feelings.

FINANCIAL CONVERSATIONS YOU MUST HAVE WITH YOUR PARTNER

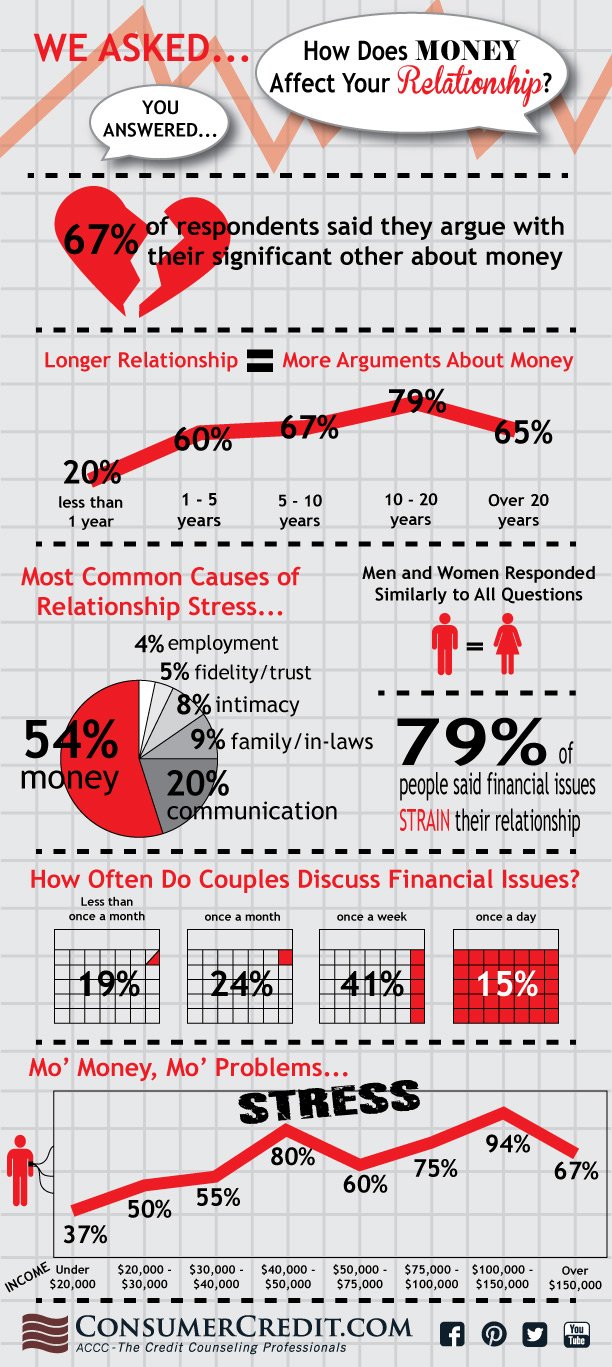

According to experts, money is actually the leading cause of strain in almost very relationships not just in the United States, but other parts of the world. That is why it is very important to be open about it with your partner and you both need to be comfortable talking about it in an open and nonjudgmental way.

Of course, money wouldn’t really be an issue if you’re still within the ‘getting to know each other stage’, but once you two have decided that you are serious about each other and are exclusively together for a while, it is now time to bring up a couple of things and one of the most important things to discuss is money.

• Talk About Debt

Honesty is indeed the best policy especially when it comes to being honest with your partner. Lies and keeping secrets would definitely strain relationships because of the trust being broken, and once trust has been destroyed, it can never be the same again. That is why if you are getting serious with each other, it is time to talk about debts. It is very important for you to be open about this to your partner, there are some cases that people get scared if their special someone is in debt depending on how much, so as early as you can, talk about it with him or her. If you wait for too long, it will definitely complicate things. Think of the roles being reversed, wouldn’t you think that you deserve to know about him or her being in debt as well? This will determine if your partner will be able to keep their minds open and understand you.

• Talk About Money Habits

This is also the time for you to talk about money habits, whether you and your partner have different styles of budgeting or if your partner budget at all. Some people are spenders and some are savers, be honest with your partner when it comes to your attitude towards money, tell him or her if you are willing to adjust or if they are willing to adjust as well, especially if there is a certain habit that you both think must be rid of, such as being a shopaholic.

• Talk About Future Money Goals

If you are in a serious relationship, you would most likely be talking about settling down at some point, and settling down comes with goals, especially financial goals. This is something you must share with your partner because he or she will be the one who will be there to help you achieve those goals. It is easier if you to have similar goals, but might be a little tough if it is in different directions. That is why it is best to talk about it now than later, so you two could work things out.

In a recent survey, 95% of adults in the United States believe that financial responsibility is an important topic to talk about with your partner. Dave Ramsey even said that both parties must be able to adapt to each other. “Your lifestyle needs to line up with what your actual income is, not what you wish it was,” he explained.