Marriage between two individuals just not just change their lives but also changes the financial situation of the couple that affects every aspect of their life together. They can face challenges from every corner beginning with personal financial goals and credit card debt.

It will be difficult for couples to understand how they can never get through these changes. However, if they decide to plan ahead they will definitely get an opportunity to build a sound financial foundation for their relationship. We are offering some tips for financial planning for couples which should be helpful when beginning a life together.

[su_quote cite="Ron Lewis" class="cust-pagination"]Financial literacy is an issue that should command our attention because many Americans are not adequately organizing finances for their education, healthcare, and retirement."[/su_quote]

Financial Planning For Couples Begins with Bank Accounts

One of the first challenges to overcome for couples is dealing with bank accounts. They should be prepared to understand whether they need to keep separate accounts or have a single joint account. They even have the option of having a joint account and to separate accounts for themselves. Regardless of their choice, this is an important step which must be considered and spoken about when getting married.

One of the first challenges to overcome for couples is dealing with bank accounts. They should be prepared to understand whether they need to keep separate accounts or have a single joint account. They even have the option of having a joint account and to separate accounts for themselves. Regardless of their choice, this is an important step which must be considered and spoken about when getting married.

We believe it is a good idea to consider the combination of both joint and individual accounts with the joint account being used for family expenses like rent, utilities, groceries, bills, mortgages and any other combined expenses. Apart from the joint account both individuals also need to have an account for themselves which can be used at their discretion. Having two accounts can make things simpler and also help to keep personal expenditure in check.

Financial Planning For Couples Also Involves Creating a Budget

After getting married it is important for the couple not just to decide how to allocate money at the bank but also to create a family budget. Both partners must contribute to any new financial issues which can include debt, assets, bills and savings. If you have created a budget in the past for yourself you will definitely see some changes when creating the new budget.

Both partners are advised to sit together and consider their combined cash flow along with any debt payments they have. They must also take into account the money they can save and find ways to combine expenses. If they are able to find answers to all the questions they would be able to create a realistic budget for their married life.

Planning For Surprises

After getting married couples will need to decide on important issues like insurance and estate planning. Couples who are both employed will be covered by the employer's health insurance plan but it is nevertheless important to look at a plan which will be beneficial for them. After getting married couples have the option of changing their health insurance plan without waiting for the open enrollment period and therefore the time should be appropriately used.

Apart from health insurance, this is also a good time for couples to consider life insurance. They may not feel the need for life insurance when they are still single because nobody is depending on them but the marriage changes everything and brings upon them responsibilities where they will have to care for each other. An unexpected surprise can be devastating to a family and therefore it is important for the couple to consider life insurance.

Retirement Planning

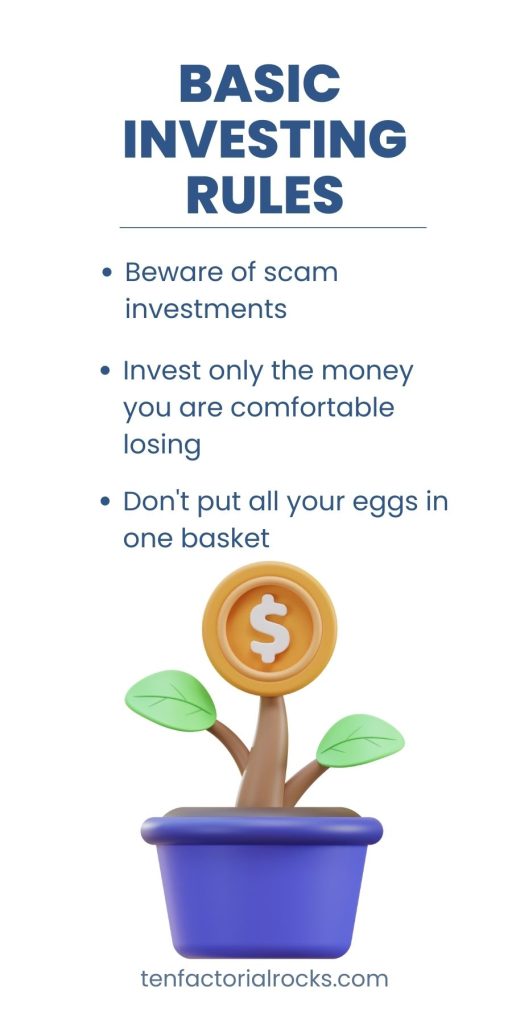

There is no reason why newly married couples cannot begin planning for their retirement from the very beginning. It will help them to plan according to their needs and set aside the funds that are required or make investments that will prove beneficial during their later years. With significant time available at their disposal they can decide on making the type of investments they desire and ensure they will have a comfortable life even after their working days.

There is no reason why newly married couples cannot begin planning for their retirement from the very beginning. It will help them to plan according to their needs and set aside the funds that are required or make investments that will prove beneficial during their later years. With significant time available at their disposal they can decide on making the type of investments they desire and ensure they will have a comfortable life even after their working days.

Financial planning for couples cannot begin without a discussion between the two. Many couples have difficulties talking about financial matters with their spouses but financial planning done without any discussions is not going to help either. Therefore couples must be prepared to talk to each other before they decide on the financial planning they have chosen for themselves.