Simply safe dividends – that’s what every dividend stock investor wants. Even if you are undecided on the ‘eternal’ debate between index fund investment and dividend stock investing, it stands to reason that you want your investments to grow. Growth, keeping up with inflation or going beyond it, can only happen if the business you are investing is stable.

Stability is always first! After that, do you want high income or high growth?

One good measure of stability is how safe the dividends paid out by a company are. If the business itself is not stable and its fortunes vary widely from year to year, the dividends paid out by the company cannot be ‘safe’. Only after you answer the ‘safe’ question with confidence can we proceed to the next question about dividend growth. In other words, after knowing the dividend is reasonably safe, then you can ask, will it grow? And can this growth keep pace with inflation or ideally, be even better?

If you have read my investing series, and reached a conclusion that dividend-oriented investing has a place in your financial independence or retirement plans, then you face the next choice.

Will you do all the analysis of dividend stocks on your own, keeping up with periodic news and financial statements, and reading up on commentary in financial community websites about the companies you are interested in? Or do you prefer to go with a recommendation of a neutral service who has nothing to hack and are not supported by the companies or any mutual funds or asset managers. A service that makes money only if the subscribers continue to pay for this service?

There are many newsletters that are in this space. Among them, I am particularly impressed by Simply Safe Dividends (SSD), a subscription service for income-oriented investors, provided by Brian Bollinger. He also writes articles for Seeking Alpha, a community of do-it-yourself investors that I read and used to contribute with original articles in the past. There are many good things about SSD but among them, I particularly like how SSD assigns a dividend ‘safety’ score (from 0 to 100) and a dividend ‘growth’ score (from 0 to 100) using a rigorous methodology. Higher the score, greater the stock ranks in safety and growth metrics.

While their methodology is proprietary, they also make allowance for investors holding broad market index funds. By design, an index fund’s dividend safety and growth scores are 50 (smack in the middle of their scoring range). So, for example, if you take the S&P 500 index with its approximately 2% current dividend yield and about 5% annual dividend growth, and consider it as just one big company, it would earn a score of 50 on both its dividend safety and growth fronts.

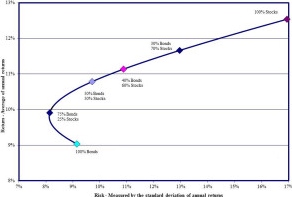

The holy curve of mainstream investing!

SSD also calculates the volatility of your investment portfolio, measured by beta. If you are interested in learning about beta and the efficient frontier, here is an article you may want to read. By definition, the overall market has a beta of 1.0. Your portfolio would have a beta of 1.0 if all you had was the S&P index fund in it. If your portfolio has a beta of 0.8, then your portfolio is 20% less volatile (or less ‘risky’) than the S&P 500, and if it has a beta of 1.3 (which can happen if you load up with high momentum, volatile stocks), then your portfolio is 30% is more volatile than the market. This works both ways, meaning if the market has a return of 10% in a year, a portfolio with 0.8 beta may return 8% while a portfolio of 1.3 may return 13%. I stress the word ‘may’ because real-life investing isn’t math and I am not a full believer of the efficient market hypothesis.

You don’t need magic beans, just stable dividends will save your retirement.

You can also take this idea further and get more ‘bang for your buck’ by optimizing your portfolio to remain fully invested in stocks and yet, have a risk profile lower than the market. What I like about SSD is that it gives as much visibility to portfolio beta as it does to dividend safety and dividend growth scores.

Consider the market’s scores as your starting point. You may then decide to make your dividend safety score higher than 50 and in the process, you may be willing to compromise on growth a little bit, in other words, accept a dividend growth score below 50. For example, an early retiree in his/her 40’s and 50’s may decide to do this because it is the portfolio’s dividend safety they care about more, because they depend on the income the portfolio generates for their living expenses. As long as the dividend is safe and it grows at a rate matching inflation (say, 3%), they are happy and may not care the about market’s dividend growth being higher. So, this investor may assemble a portfolio of dividend stocks with a safety score of say, 60 (safer than market) and a growth score of say, 40 (slightly lower than market).

Importantly, this investor may achieve this, while enjoying a current dividend yield of say, 4%, whereas the market’s yield is only 2%. This kind of dividend yield is possible with investments that rank high on the ‘yield’ score but come with lower ‘growth’ scores – you can’t have them all! Still, this investor gets twice the passive income of the index fund investor, which is available to spend today. On a pure income basis, the index fund investor will take more than 30 years to catch up to the passive income that this dividend investor gets every year.

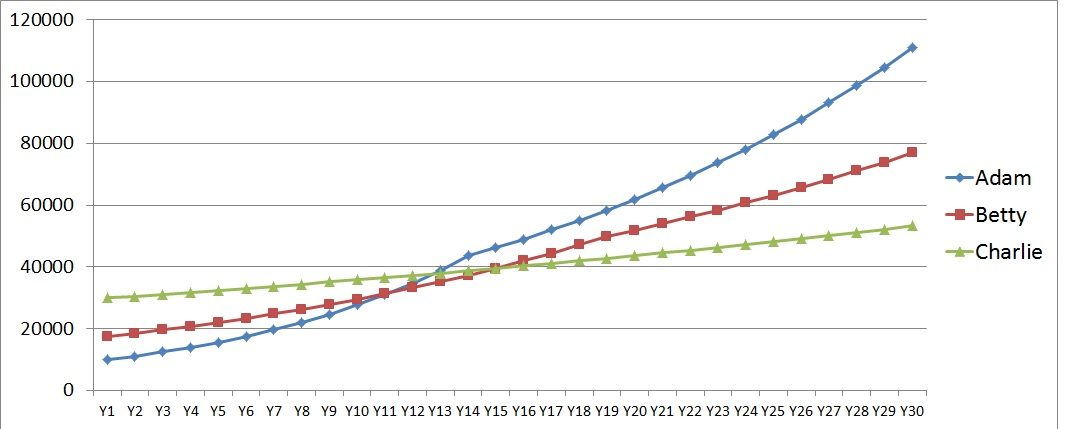

Don’t believe me? Do this Math exercise: Investor A has 4% dividend yield, growing at 3% a year. Investor B has 2% dividend yield, growing at 5% a year. Take any investment amount to begin with and see how long it takes for B’s annual income to catch up to A’s. Do a cash flow table in Excel or Google Sheets to see this for yourself!.

SSD allows you to be that Investor A and avoid the regret group of early retirees.

As we saw in Part 5 of my Investing Series, the only price this investor pays is that the total return may be lower than market. I say ‘may be’ because while this is logical, the actual results depend on the performance of stocks chosen in the portfolio. Still, dividend stocks don’t exist in a parallel universe, they are part of the stock market and are influenced by all the market forces and dynamics.

To understand this example better, consider this chart. The example behind this chart is fully explained in this post.

Moderated Growth of Dividends over 30 Years

For the purpose of this post, what matters, and where SSD shines, is that it gives you the freedom to choose the dividend growth path of Adam, Betty or Charlie – depending on where you are in your life path and investing cycle.

I am very careful about endorsing any investment service because this industry is known for hucksters and high-fee gougers. I am not getting paid by SSD for this recommendation. I only wanted to share with you all what I feel is a good service for the cost. Importantly, SSD addresses the time problem do-it-yourself investors have in researching and selecting promising dividend stocks to meet our passive income needs.

I have reached out to Brian at Simply Safe Dividends, and he offers a full access free trial (no credit card required, no strings attached), which you can register for by using this link. Just to add, I am not getting paid by SSD for any referrals either. I am doing this only because I feel SSD deserves a closer look by all serious investors who want sustainable and growing passive income.

Raman Venkatesh is the founder of Ten Factorial Rocks. Raman is a ‘Gen X’ corporate executive in his mid 40’s. In addition to having a Ph.D. in engineering, he has worked in almost all continents of the world. Ten Factorial Rocks (TFR) was created to chronicle his journey towards retirement while sharing his views on the absurdities and pitfalls along the way. The name was taken from the mathematical function 10! (ten factorial) which is equal to 10 x 9 x 8 x 7 x 6 x 5 x 4 x 3 x 2 x 1 = 3,628,800.

2 comments on “Simply Safe Dividends”